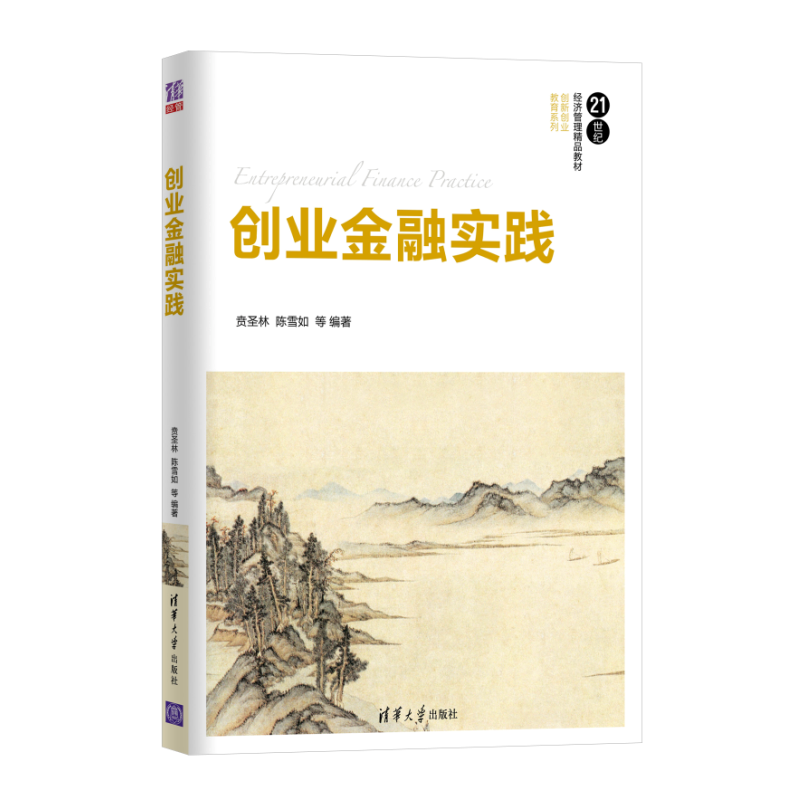

- ISBN:9787302478423

- 装帧:一般胶版纸

- 册数:暂无

- 重量:暂无

- 开本:32开

- 页数:259

- 出版时间:2017-08-01

- 条形码:9787302478423 ; 978-7-302-47842-3

本书特色

本书结合中国现阶段经济社会背景,以全面的理论框架和丰富的实践案例、多角度的“本土化”分析,向创业者展现创业过程中与创业金融活动有关的基本概念、操作流程、现实问题和解决方案,为广大创业者和创业团队快速全面地了解创业金融的知识体系和发展脉络、实际掌握创业金融基本运用方法和模式提供帮助。 本书可作为商学院MBA、EMBA和本科生创业金融、创业投资等相关课程的参考资料,也是一本为所有对创业以及创业金融感兴趣的社会人士准备的专业科普手册。

内容简介

这是一部创业者必读的金融实践教程,透过丰富的案例以及*的理论分析,帮助读者准确把握创业金融成功的关键。

目录

作者简介

贲圣林,浙江大学管理学院教授,浙大互联网金融研究院创始院长。在开启全职学术生涯前,其已在著名金融机构工作20年,历任荷兰银行高级副总裁兼流动资金业务中国区总经理,汇丰银行董事总经理兼工商金融业务中国区总经理,摩根大通银行(中国)有限公司行长及摩根大通环球企业银行全球领导小组成员。目前主要社会兼职有全国工商联执委、中国人民大学国际货币研究所执行所长、浙江省人民政府参事、浙江互联网金融联盟联合主席等。

-

思想道德与法治(2021年版)

¥6.8¥18.0 -

中医基础理论

¥51.7¥59.0 -

落洼物语

¥9.4¥28.0 -

习近平新时代中国特色社会主义思想概论

¥18.2¥26.0 -

当代中国政府与政治(新编21世纪公共管理系列教材)

¥36.0¥48.0 -

毛泽东思想和中国特色社会主义理论体系概论(2021年版)

¥9.0¥25.0 -

艺术学概论

¥14.5¥37.4 -

粒子输运数值计算方法及其应用

¥42.8¥58.0 -

艺术学概论

¥60.2¥79.0 -

毛泽东思想和中国特色社会主义理论体系概论

¥10.5¥25.0 -

智能控制

¥40.2¥56.0 -

社会学概论(第二版)

¥34.0¥55.0 -

法理学(第二版)

¥18.0¥50.0 -

全国中医药行业高等教育“十三五”规划教材中医养生学/马烈光/十三五规划

¥36.8¥55.0 -

基于python的从学习编程到解决问题

¥35.4¥53.8 -

水利工程监理

¥28.3¥42.0 -

新编大学生军事理论与训练教程

¥13.7¥39.8 -

世界现代史(1900-2000)

¥31.4¥80.0 -

水电站

¥24.4¥36.0 -

公路工程机械化施工技术-(第二版)

¥18.6¥32.0