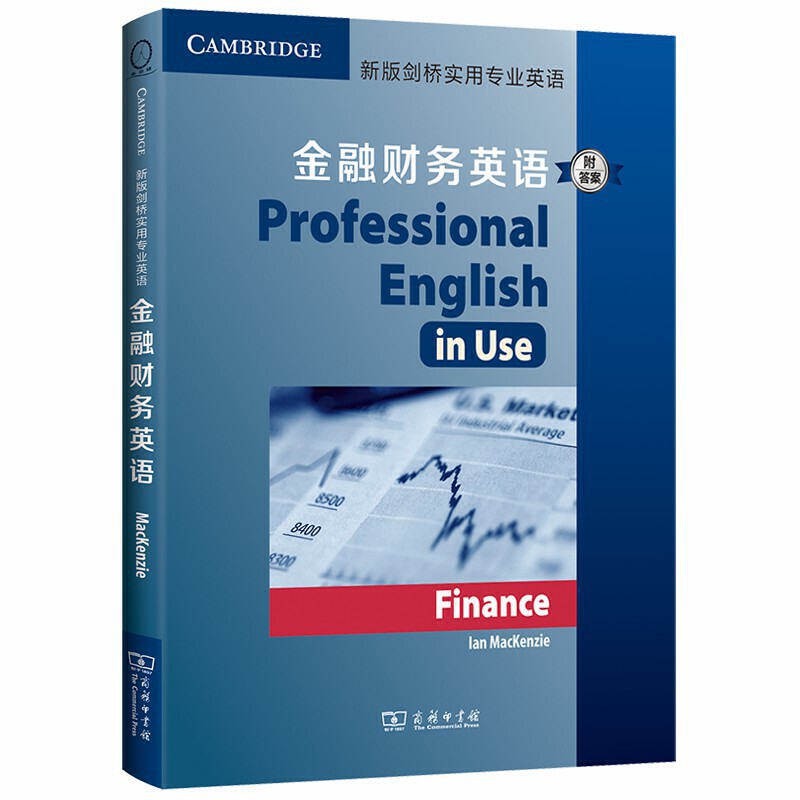

新版剑桥实用专业英语新版剑桥实用专业英语:金融财务英语(附答案)

- ISBN:9787100183222

- 装帧:平装-胶订

- 册数:暂无

- 重量:暂无

- 开本:其他

- 页数:140

- 出版时间:2020-06-01

- 条形码:9787100183222 ; 978-7-100-18322-2

本书特色

《新版剑桥实用专业英语:金融财务英语(附答案)》涉及四大领域:会计学、银行业、公司理财以及经济与贸易。每个领域又分多个单元,分别叙述该领域的热门主题,比如成本会计、资产负债表、中央银行、利率、股票、债券、国际贸易和汇率等。每个单元都有关键词和表达方式的详解以及练习,供学习者检查和进一步理解所学到的知识。每单元还设计了“请你参与”部分,为学习者提供情境模拟的机会。本书*后附有练习题答案和索引,供读者自我检测和深入学习。

内容简介

《新版剑桥实用专业英语:金融财务英语(附答案)》涉及四大领域:会计学、银行业、公司理财以及经济与贸易。每个领域又分多个单元,分别叙述该领域的热门主题,比如成本会计、资产负债表、中央银行、利率、股票、债券、靠前贸易和汇率等。每个单元都有关键词和表达方式的详解以及练习,供学习者检查和进一步理解所学到的知识。每单元还设计了“请你参与”部分,为学习者提供情境模拟的机会。本书很后附有练习题答案和索引,供读者自我检测和深入学习。

目录

作者简介

伊恩•麦肯齐出生和成长在马萨诸塞,毕业于哈佛大学,曾著有Feast Day。他在商务英语领域有丰富的教学和实践经验。

-

THE LITTLE PRINCE-小王子

¥5.3¥19.8 -

了不起的盖茨比(纯英文)/床头灯英语.3000词读物

¥4.5¥12.8 -

安徒生童话精选

¥13.6¥40.0 -

地心游记(纯英文)/床头灯英语.3000词读物

¥5.4¥15.8 -

茶花女

¥4.0¥12.0 -

考研英语背单词20个词根词缀

¥1.4¥3.2 -

MADAME BOVARY-包法利夫人

¥9.9¥36.8 -

THE GREAT GATSBY-了不起的盖茨比

¥5.0¥16.8 -

哈利.波特与魔法石(英汉对照版)

¥38.0¥55.0 -

自然与社会-读懂汉字

¥26.9¥96.0 -

命案目睹记

¥14.2¥33.8 -

嘉莉妺妺-(英语原著版.第六辑)

¥7.8¥26.0 -

威克菲尔德的牧师-(英语原著版.第三辑)

¥4.2¥12.0 -

马丁.伊登-(英语原著版.第三辑)

¥6.5¥19.0 -

夏洛的网(平装双语版)//2023新定价

¥36.0¥58.0 -

老人与海 英文版(新版)

¥19.5¥39.8 -

华氏451(全新特别版)

¥37.1¥58.0 -

浮生六记(汉英对照)

¥17.6¥65.0 -

新东方 10天掌握KET写作

¥31.7¥48.0 -

王子与贫儿

¥22.7¥42.0