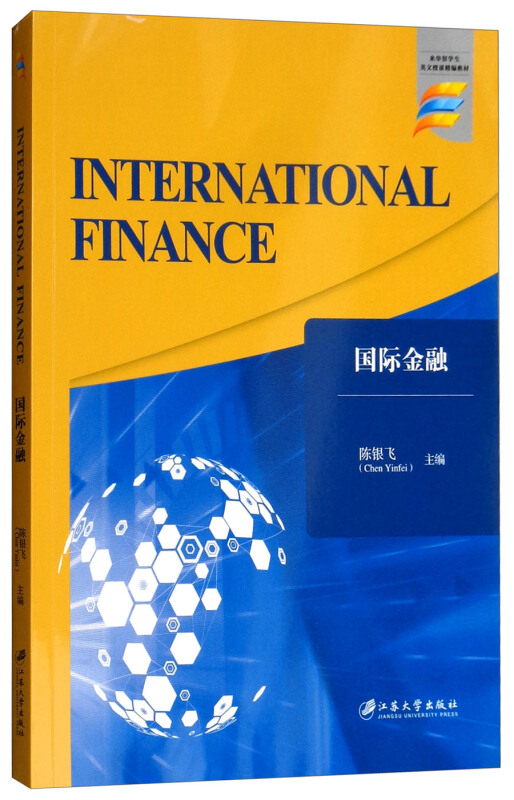

来华留学生英文授课精编教材国际金融 INTERNATIONALFINANCE/陈银飞

温馨提示:5折以下图书主要为出版社尾货,大部分为全新(有塑封/无塑封),个别图书品相8-9成新、切口有划线标记、光盘等附件不全详细品相说明>>

- ISBN:9787568407410

- 装帧:一般胶版纸

- 册数:暂无

- 重量:暂无

- 开本:其他

- 页数:232

- 出版时间:2015-12-01

- 条形码:9787568407410 ; 978-7-5684-0741-0

内容简介

International finance is the branch of financial economics that deals with monetary and macroeconomic interrelations between two or more countries. It concemed with topics that include dynamics of the global financial system, intemational monetary systems, balance of payments, exchange rates, and foreign direct investment, Intemational finance also involves issues pertaining to financial management, such as political and foreign exchange risk that comes with managing multinational corporations, and how these topics relate to intemational trade. This textbook is aimed to aid economy and management undergraduate students in understanding the theories of Mundell-Fleming model, the optimum currency area theory, purchasing power parity, interest rate parity, and the international Fisher effect, and to help them to gain the ability to assess and manage international risks, such as political risk and foreign exchange risk, including transaction exposure, economic exposure, and translation exposure. I would like to acknowledge the many insights and suggestions provided by the reviewers, as well as a number of our colleges and students. I also thank those who provided the aids in publishing this book, including the sponsor, Overseas Education College of Jiangsu University and the editor, Ms. Liu Yan.

目录

Chapter 1 Foreign Exchange and Foreign Exchange Market

1.1 Foreign Exchange

1.2 Foreign Exchange Rate

1.3 The Major Currencies and Currency Codes

1.4 Foreign Exchange Market

1.5 Some Basic Concepts

Chapter 2 Spot Foreign Exchange

2.1 Spot Transaction

2.2 Spot Foreign Exchange Quoting Conventions

2.3 Cross-rate Calculations

2.4 Position Keeping

2.5 Exchange Rate Arbitrage

Chapter 3 Forward Market

3.1 Why Forward?

3.2 Forward Trade Timing Conventions

3.3 Forward Rate Quotations

3.4 Cross-rate Calculations

Chapter 4 Currency Derivatives

4.1 Currency Futures

4.2 Currency Options

Chapter 5 International Money and Bond Market

5.1 The Eurocurrency and Offshore Currency Market

5.2 Foreign Bonds and Eurobonds

……

PART TWO THEORY

PART THREE MANAGEMENT

PART FOUR SYSTEM AND INSTITUTIONS

References

-

李诞脱口秀工作手册

¥16.0¥42.0 -

旧中国国家银行纸币图录-(修订版)

¥17.4¥58.0 -

富爸爸穷爸爸

¥40.9¥89.0 -

萨缪尔森谈失业与通货膨胀

¥8.0¥25.0 -

底层逻辑:看清这个世界的底牌

¥33.8¥69.0 -

图解博弈论

¥12.2¥38.0 -

理想书店(八品)

¥26.2¥79.5 -

投资人和你想的不一样

¥19.5¥65.0 -

文案高手

¥11.5¥36.0 -

富爸爸 穷爸爸 从小就学会像富人那样思考

¥15.1¥39.8 -

麦肯锡工作法-麦肯锡精英的39个工作习惯

¥12.2¥32.0 -

金字塔原理

¥68.6¥88.0 -

原则

¥68.6¥98.0 -

深度成交:如何实现可持续性销售

¥12.2¥38.0 -

麦肯锡图表工作法

¥24.4¥49.8 -

管理的常识

¥8.6¥26.8 -

民主与大坝-美国田纳西河流域管理局实录

¥15.1¥39.8 -

宗庆后内部讲话-关键时.宗庆后说了什么

¥12.7¥39.8 -

萨缪尔森谈金融贸易与开放经济

¥8.0¥25.0 -

罗辑思维:多角度理解历史:历史篇

¥17.2¥39.9