暂无评论

图文详情

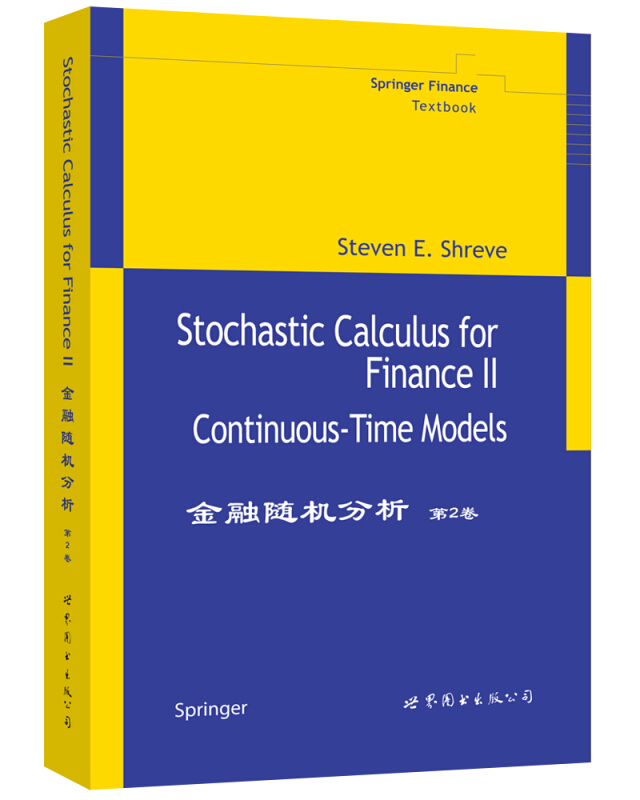

- ISBN:9787506272889

- 装帧:一般胶版纸

- 册数:暂无

- 重量:暂无

- 开本:16开

- 页数:572

- 出版时间:2020-07-01

- 条形码:9787506272889 ; 978-7-5062-7288-9

内容简介

《金融随机分析》是一套随机分析在定量经济学领域中应用方面的有名教材,作者在该领域享有盛誉,全书共分2卷。

卷主要包括随机分析的基础性知识和离散时间模型;第2卷主要包括连续时间模型和该模型经济学中的应用。就其内容而言,第2卷有较为实际的可操作性的定量经济学内容,同时也包含了较为完整的随机微分方程理论。本书各章有习题,适用于掌握微积积分基础知识的大学高年级本科生和硕士研究生。

目录

1 General Probability Theory

1.1 Infinite Probability Spaces

1.2 Random Variables and Distributions

1.3 Expectations

1.4 Convergence of Integrals

1.5 Computation of Expectations

1.6 Change of Measure

1.7 Summary

1.8 Notes

1.9 Exercises

2 Information and Conditioning

2.1 Information and o-algebras

2.2 Independence

2.3 General Conditional Expectations

2.4 Summary

2.5 Notes

2.6 Exercises

3 Brownian Motion

3.1 Introduction

3.2 Scaled Random Walks

3.2.1 Symmetric Random Walk

3.2.2 Increments of the Symmetric Random Walk

3.2.3 Martingale Property for the Symmetric Random Walk

3.2.4 Quadratic Variation of the Symmetric Random Walk

3.2.5 Scaled Symmetric Random Walk

3.2.6 Limiting Distribution of the Scaled Random Walk

3.2.7 Log-Normal Distribution as the Limit of the Binomial Model

3.3 Brownian Motion

3.3.1 Definition of Brownian Motion

3.3.2 Distribution of Brownian Motion

3.3.3 Filtration for Brownian Motion

3.3.4 Martingale Property for Brownian Motion

3.4 Quadratic Variation

3.4.1 First-Order Variation

3.4.2 Quadratic Variation

3.4.3 Volatility of Geometric Brownian Motion

3.5 Markov Property

3.6 First Passage Time Distribution

3.7 Reflection Principle

3.7.1 Reflection Equality

3.7.2 First Passage Time Distribution

3.7.3 Distribution of Brownian Motion and Its Maximum

3.8 Summary

3.9 Notes

3.10 Exercises

4 Stochastic Calculus

4.1 Introduction

4.2 Ito's Integral for Simple Integrands

4.2.1 Construction of the Integral

4.2.2 Properties of the Integral

4.3 Ito's Integral for General Integrands

4.4 Ito-Doeblin Formula

4.4.1 Formula for Brownian Motion

4.4.2 Formula for Ito Processes

4.4.3 Examples

4.5 Black-Scholes-Merton Equation

4.5.1 Evolution of Portfolio Value

4.5.2 Evolution of Option Value

4.5.3 Equating the Evolutions

4.5.4 Solution to the Black-Scholes-Merton Equation

4.5.5 The Greeks

4.5.6 Put-Call Parity

4.6 Multivariable Stochastic Calculus

4.6.1 Multiple Brownian Motions

4.6.2 Ito-Doeblin Formula for Multiple Processes

4.6.3 Recognizing a Brownian Motion

4.7 Brownian Bridge

4.7.1 Gaussian Processes

4.7.2 Brownian Bridge as a Gaussian Process

4.7.3 Brownian Bridge as a Scaled Stochastic Integral

4.7.4 Multidimensional Distribution of the Brownian Bridge

4.7.5 Brownian Bridge as a Conditioned Brownian Motion

4.8 Summary

4.9 Notes

4.10 Exercises

5 Risk-Neutral Pricing

5.1 Introduction

5.2 Risk-Neutral Measure

5.2.1 Girsanov's Theorem for a Single Brownian Motion

5.2.2 Stock Under the Risk-Neutral Measure

5.2.3 Value of Portfolio Process Under the Risk-Neutral Measure

5.2.4 Pricing Under the Risk-Neutral Measure

5.2.5 Deriving the Black-Scholes-Merton Formula

5.3 Martingale Representation Theorem

5.3.1 Martingale Representation with One Brownian Motion

5.3.2 Hedging with One Stock

5.4 Fundamental Theorems of Asset Pricing

5.4.1 Girsanov and Martingale Representation Theorems

5.4.2 Multidimensional Market Model

5.4.3 Existence of the Risk-Neutral Measure

5.4.4 Uniqueness of the Risk-Neutral Measure

5.5 Dividend-Paying Stocks

5.5.1 Continuously Paying Dividend

5.5.2 Continuously Paying Dividend with Constant Coefficients

5.5.3 Lump Payments of Dividends

5.5.4 Lump Payments of Dividends with Constant Coefficients

5.6 Forwards and Futures

5.6.1 Forward Contracts

5.6.2 Futures Contracts

5.6.3 Forward-Futures Spread

5.7 Summary

5.8 Notes

5.9 Exercises

6 Connections with Partial Differential Equations

6.1 Introduction

6.2 Stochastic Differential Equations

6.3 The Markov Property

6.4 Partial Differential Equations

6.5 Interest Rate Models

6.6 Multidimensional Feynman-Kac Theorems

6.7 Summary

6.8 Notes

6.9 Exercises

7 Exotic Options

7.1 Introduction

7.2 Maximum of Brownian Motion with Drift

7.3 Knock-out Barrier Options

7.3.1 Up-and-Out Call

7.3.2 Black-Scholes-Merton Equation

7.3.3 Computation of the Price of the Up-and-Out Call

7.4 Lookback Options

7.4.1 Floating Strike Lookback Option

7.4.2 Black-Scholes-Merton Equation

7.4.3 Reduction of Dimension

7.4.4 Computation of the Price of the Lookback Option

7.5 Asian Options

7.5.1 Fixed-Strike Asian Call

7.5.2 Augmentation of the State

7.5.3 Change of Numeraire

7.6 Summary

7.7 Notes

7.8 Exercises

8 American Derivative Securities

8.1 Introduction

8.2 Stopping Times

8.3 Perpetual American Put

8.3.1 Price Under Arbitrary Exercise

8.3.2 Price Under Optimal Exercise

8.3.3 Analytical Characterization of the Put Price

8.3.4 Probabilistic Characterization of the Put Price

8.4 Finite-Expiration American Put

8.4.1 Analytical Characterization of the Put Price

8.4.2 Probabilistic Characterization of the Put Price

8.5 American Call

8.5.1 Underlying Asset Pays No Dividends

8.5.2 Underlying Asset Pays Dividends

8.6 Summary

8.7 Notes

8.8 Exercises

9 Change of Numeraire

9.1 Introduction

9.2 Numeraire

9.3 Foreign and Domestic Risk-Neutral Measures

9.3.1 The Basic Processes

9.3.2 Domestic Risk-Neutral Measure

9.3.3 Foreign Risk-Neutral Measure

9.3.4 Siegel's Exchange Rate Paradox

9.3.5 Forward Exchange Rates

9.3.6 Garman-Kohlhagen Formula

9.3.7 Exchange Rate Put-Call Duality

9.4 Forward Measures

9.4.1 Forward Price

9.4.2 Zero-Coupon Bond as Numeraire

9.4.3 Option Pricing with a Random Interest Rate

9.5 Summary

9.6 Notes

9.7 Exercises

10 Term-Structure Models

10.1 Introduction

10.2 Affine-Yield Models

10.2.1 Two-Factor Vasicek Model

10.2.2 Two-Factor CIR Model

10.2.3 Mixed Model

10.3 Heath-Jarrow-Morton Model

10.3.1 Forward Rates

10.3.2 Dynamics of Forward Rates and Bond Prices

10.3.3 No-Arbitrage Condition

10.3.4 HJM Under Risk-Neutral Measure

10.3.5 Relation to Afine-Yield Models

10.3.6 Implementation of HJM

10.4 Forward LIBOR Model

10.4.1 The Problem with Forward Rates

10.4.2 LIBOR and Forward LIBOR

10.4.3 Pricing a Backset LIBOR Contract

10.4.4 Black Caplet Formula

10, .4.5 Forward LIBOR and Zero-Coupon Bond Volatilities

10.4.6 A Forward LIBOR Term-Structure Model

10.5 Summary

10.6 Notes

10.7 Exercises

11 Introduction to Jump Processes

11.1 Introduction

11.2 Poisson Process

11.2.1 Exponential Random Variables

11.2.2 Construction of a Poisson Process

11.2.3 Distribution of Poisson Process Increments

11.2.4 Mean and Variance of Poisson Increments

11.2.5 Martingale Property

11.3 Compound Poisson Process

11.3.1 Construction of a Compound Poisson Process

11.3.2 Moment-Generating Function

11.4 Jump Processes and Their Integrals

11.4.1 Jump Processes

11.4.2 Quadratic Variation

11.5 Stochastic Calculus for Jump Processes

11.5.1 It6-Doeblin Formula for One Jump Process

11.5.2 Ito-Doeblin Formula for Multiple Jump Processes

11.6 Change of Measure

11.6.1 Change of Measure for a Poisson Process

11.6.2 Change of Measure for a Compound Poisson Process

11.6.3 Change of Measure for a Compound Poisson Process and a Brownian Motion

11.7 Pricing a European Call in a Jump Model

11.7.1 Asset Driven by a Poisson Process

11.7.2 Asset Driven by a Brownian Motion and a Compound Poisson Process

11.8 Summary

11.9 Notes

11.10 Exercises

A Advanced Topics in Probability Theory

A.1 Countable Additivity

A.2 Generating o-algebras

A.3 Random Variable with Neither Density nor Probability Mass Function

B Existence of Conditional Expectations

C Completion of the Proof of the Second Fundamental Theorem of Asset Pricing

References

Index

展开全部

作者简介

卡耐基·梅隆大学的计算金融MSCF项目是美国金融工程的带头者,历史悠久,在华尔街亦享有盛誉。 本书作者Steven E.Shreve教授正是该项目的创办人之一,他经常和华尔街大公司的负责人们沟通,了解行业内新的发展趋势以在课程中加以改进,极大地促进了课程的优化。因而,由他所写的《金融随机分析》(**、二卷)一直是随机分析在数量金融领域应用方面的著名教材,许多世界名校将其作为金融工程专业的必修教材。

本类五星书

本类畅销

-

贼巢-美国金融史上最大内幕交易网的猖狂和覆灭

¥48.6¥139.9 -

广告, 艰难的说服--广告对美国社会影响的不确定性

¥10.5¥27.0 -

李诞脱口秀工作手册

¥23.9¥42.0 -

底层逻辑:看清这个世界的底牌

¥48.4¥69.0 -

故事力法则

¥15.4¥48.0 -

以利为利:财政关系与地方政府行为

¥71.8¥78.0 -

直播电商实务

¥38.2¥59.0 -

富爸爸穷爸爸

¥79.2¥89.0 -

格局

¥36.4¥59.0 -

金字塔原理

¥78.3¥88.0 -

掌控习惯:如何养成好习惯并戒除坏习惯

¥37.5¥58.0 -

360度领导力:中层领导者全方位领导力提升技巧(典藏版)

¥51.7¥78.0 -

精准推送

¥18.5¥45.0 -

原则

¥54.9¥98.0 -

涛动周期论-经济周期决定人生财富命运

¥64.4¥99.0 -

可复制的领导力

¥34.8¥49.0 -

10人以下小团队管理手册(八品)

¥10.6¥32.0 -

像高手一样发言+像高手一样脱稿讲话2本套

¥69.7¥99.6 -

小米创业思考

¥65.5¥86.0 -

优势谈判

¥41.8¥68.0