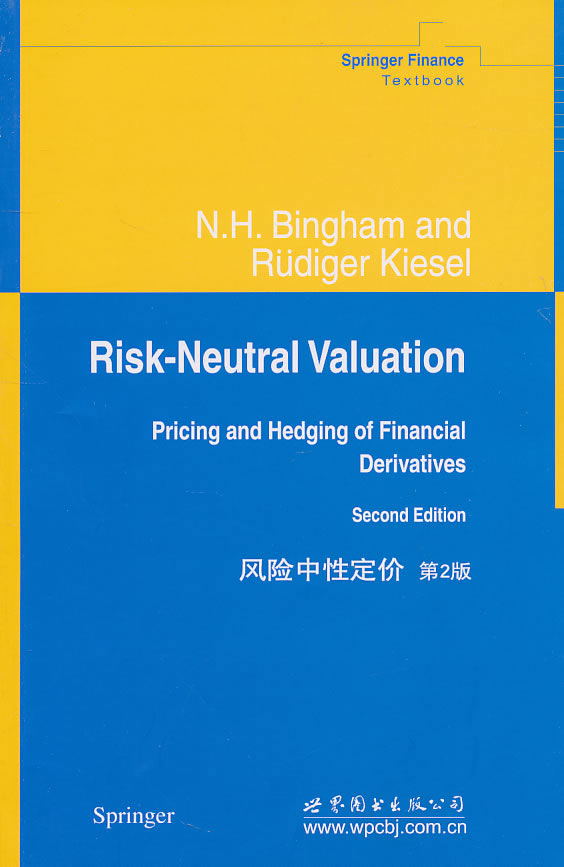

- ISBN:9787510029707

- 装帧:一般胶版纸

- 册数:暂无

- 重量:暂无

- 开本:24

- 页数:18

- 出版时间:2011-01-01

- 条形码:9787510029707 ; 978-7-5100-2970-7

本书特色

宾汉姆的这本《风险中性定价(第2版)》是一部讲述风险中性评估理论的金融实践应用教材。风险中性评估原理起源于十九世纪八十年代引入,已经发展成为研究金融衍生品定价和对冲的重要工具。书中内容自称体系,讲述中性定价背后的概率论知识及其在定价理论和金融衍生品套利中的应用。从概率的角度,离散和连续时间随机过程都给予充分的考虑。前六章为现代随机金融的基础和一般原理奠定了基础,与**版相比,更加全面和完善。为了将*新的发展结果囊括其中,第七、八章重新安排和扩充讲述了不完全市场和利率理论,新添加了第九章讲述信用风险模型。

内容简介

Books are written for use, and the best compliment that the community in the field could have paid to the first edition of 1998 was to buy out the printrun, and that of the corrected printing, as happened. Meanwhile, the fast-developing field of mathematical finance had moved on, as had our thinking, and it seemed better to recognize this and undertake a thorough-going re-write for the second edition than to tinker with the existing text.

目录

preface to the first edition

1.derivative background

1.1 financial markets and instruments

1.1.1 derivative instruments

1.1.2 underlying securities

1.1.3 markets

1.1.4 types of traders

1.1.5 modeling assumptions

1.2 arbitrage

1.3 arbitrage relationships

1.3.1 fundamental determinants of option values

1.3.2 arbitrage bounds

1.4 single-period market models

1.4.1 a fundamental example

-

贼巢-美国金融史上最大内幕交易网的猖狂和覆灭

¥48.6¥139.9 -

广告, 艰难的说服--广告对美国社会影响的不确定性

¥10.5¥27.0 -

以利为利:财政关系与地方政府行为

¥71.8¥78.0 -

富爸爸穷爸爸

¥44.6¥89.0 -

故事力法则

¥15.4¥48.0 -

格局

¥36.4¥59.0 -

10人以下小团队管理手册(八品)

¥10.6¥32.0 -

掌控习惯:如何养成好习惯并戒除坏习惯

¥34.1¥58.0 -

360度领导力:中层领导者全方位领导力提升技巧(典藏版)

¥51.7¥78.0 -

直播电商实务

¥38.2¥59.0 -

李诞脱口秀工作手册

¥23.9¥42.0 -

亲历纽交所

¥28.4¥49.0 -

金字塔原理

¥44.1¥88.0 -

原则

¥54.9¥98.0 -

可复制的领导力

¥34.8¥49.0 -

像高手一样发言+像高手一样脱稿讲话2本套

¥69.7¥99.6 -

小米创业思考

¥65.5¥86.0 -

优势谈判

¥41.8¥68.0 -

底层逻辑:看清这个世界的底牌

¥48.4¥69.0 -

学会提问

¥45.9¥69.0