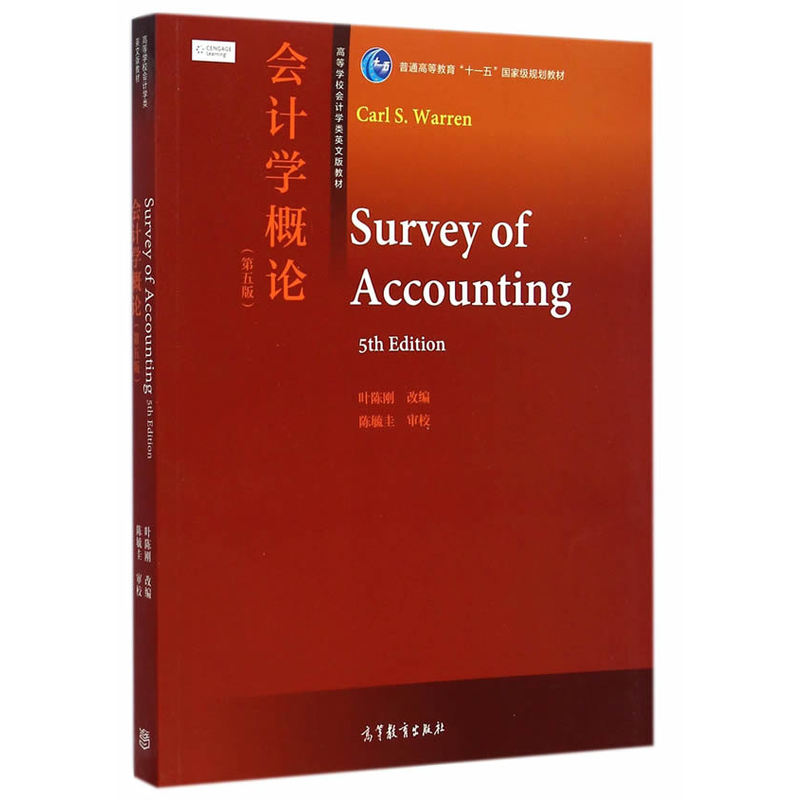

- ISBN:9787040414738

- 装帧:一般胶版纸

- 册数:暂无

- 重量:暂无

- 开本:16开

- 页数:469

- 出版时间:2015-01-01

- 条形码:9787040414738 ; 978-7-04-041473-8

本书特色

沃伦编的《会计学概论(第5版高等学校会计学类英文版教材)》是为没有会计知识背景的读者学习会计学而编*的,全书概括论述了财务会计和管理会计中的一些基础知识和基本理论问题,前10章主要阐述的是关于财务会计方面的论题;后5章主要阐述的是关于管理会计方面的内容。全书的重点在于强调经理人、投资者或其他的公司股东应该如何使用公司财务报告,以便做出正确有效的经营决策。书中各章均安排了一些大公司的案例,以便读者融会贯通,运用 *新的会计理论来*好地指导丰富多彩的商务实践。 本书可供非会计学专业本科生和mba学生使用。 同时适合贸易、金融、营销等领域的人士学习会计学使用。

内容简介

本书是为没有会计知识背景的读者学习会计学而编著的,全书概括论述了财务会计和管理会计中的一些基础知识和基本理论问题,前10章主要阐述的是关于财务会计方面的论题;后5章主要阐述的是关于管理会计方面的内容。全书的重点在于强调经理人、投资者或其他的公司股东应该如何使用公司财务报告,以便做出正确有效的经营决策。书中各章均安排了一些大公司的案例,以便读者融会贯通,运用*新的会计理论来更好地指导丰富多彩的商务实践。

目录

作者简介

Carl S.Warren,Dr. Carl S. Warren is Professor Emeritus of Accounting at the University of Georgia, Athens. For over twenty-five years, Professor Warren has taught all levels of accounting classes. In recent years, Professor Warren has focused his teaching efforts on principles of accounting and auditing courses. Professor Warren has taught classes at the University of Iowa, Michigan StateUniversity, and University of Chicago. Professor Warren received his doctorate degree (PhD) from Michigan State University and his undergraduate (BBA) and master's (MA) degrees from the University of Iowa. During hiscareer, Professor Warren published numerous articles in professional journals, including The Accounting Review, Journal of Accounting Research, Journal of Accountancy, The CPA Journal, and Auditing: A Journal of Practice & Theory.Professor Warren's outside interests include writing short stories and novels,oil painting, handball, golf, skiing, backpacking, and fly-fishing.

-

文徵明书前后赤壁赋

¥35.8¥58.0 -

2022特岗教师招聘考试辅导教材·体育学科专业知识

¥21.3¥58.0 -

高等学校电子信息类专业系列教材现代数字系统设计/基于Intel FPGA可编程逻辑器件与VHDL

¥58.3¥69.0 -

中国建筑文化遗产-文化城市:中国淮安-5

¥21.9¥58.0 -

奇妙地理世界系列;地球上的未解之谜

¥11.2¥23.8 -

机械设计习题与解析(第二版)

¥40.8¥49.8 -

中华文脉:人间惆怅客—纳兰性德

¥42.8¥58.0 -

椭圆轨道近距离相对导航与姿轨一体化控制

¥41.8¥68.0 -

祖先-易中天中华史

¥14.3¥29.0 -

销售女神徐鹤宁-教你创造销售奇迹

¥15.9¥49.8

-

思想道德与法治(2021年版)

¥6.8¥18.0 -

中医基础理论

¥51.7¥59.0 -

当代中国政府与政治(新编21世纪公共管理系列教材)

¥36.0¥48.0 -

毛泽东思想和中国特色社会主义理论体系概论(2021年版)

¥9.0¥25.0 -

落洼物语

¥9.4¥28.0 -

习近平新时代中国特色社会主义思想概论

¥18.2¥26.0 -

艺术学概论

¥14.5¥37.4 -

粒子输运数值计算方法及其应用

¥42.8¥58.0 -

言语治疗学·全国中医药行业高等教育“十四五”规划教材

¥49.2¥56.0 -

艺术学概论

¥60.2¥79.0 -

毛泽东思想和中国特色社会主义理论体系概论

¥10.5¥25.0 -

马克思主义基本原理2021年版

¥8.4¥23.0 -

智能控制

¥40.2¥56.0 -

社会学概论(第二版)

¥34.0¥55.0 -

法理学(第二版)

¥18.0¥50.0 -

全国中医药行业高等教育“十三五”规划教材中医养生学/马烈光/十三五规划

¥36.8¥55.0 -

基于python的从学习编程到解决问题

¥35.4¥53.8 -

水利工程监理

¥28.3¥42.0 -

新编大学生军事理论与训练教程

¥13.7¥39.8 -

马克思主义理论研究和建设工程重点教材:管理学(本科教材)

¥18.3¥48.0